AFTER five years of crisis and a bail-out costing over €64 billion ($87 billion), Ireland’s banks appear to be on the mend. On December 4th Bank of Ireland announced plans to repay part of its bail-out, €1.8 billion of preference shares, to the Irish government. But Ireland is still suffering from the baleful consequences of its bank rescue in other ways. As well as propelling public debt from 25% of GDP to 123%, it has made Ireland’s banking industry one of the most concentrated in the world. Of Ireland’s six big native banks before the crisis, only three are now still in business—all of which have big public shareholdings. The Irish state owns virtually all of Allied Irish Bank (AIB) and Permanent TSB, as well as a 14% stake in Bank of Ireland.

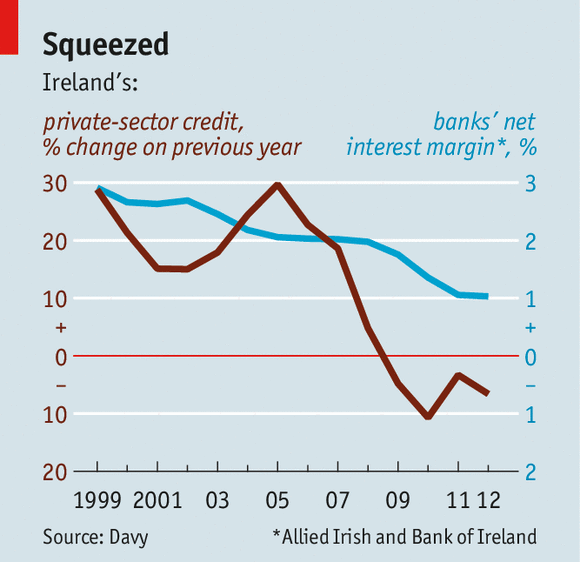

Foreign-owned banks, meanwhile, are leaving. British-based Bank of Scotland returned its local licence in 2010; Denmark’s Danske Bank and ACCBank, a subsidiary of Rabobank of the Netherlands, plan to do the same. The foreigners complain that shrinking borrowing, along with paper-thin interest margins (the difference between the rates at which banks borrow and lend), make it unattractive for them to stay (…