A recent Wall Street Journal article captures the conundrum CFOs currently have with big data accurately: “Big data seems tailor-made for finance chiefs. So why aren’t more of them using it?”

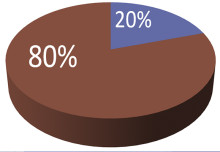

It’s a good question. But for a range of reasons, many CFOs have been slow to embrace the big data trend. According to an American Express Global Corporate Payments survey, 40 percent of CFOs claimed they wouldn’t increase spending on big data over the next year.

Here are three things CFOs from middle market companies need to know about big data.

1. It’s here to stay.

Now, at more than any other point in history, we sit on dunes and dunes of data. For CFOs, data can help your finance organization—and your company, for that matter—play offense. As Mark Stull, CFO of Liberty Hardware, says: “It’s our ability to interpret the numbers and provide analytics—true, deep analytics of the business to point our partners at opportunities, or, arm our salesforce with information.”

2. It’s your friend.

Chevron, the No. 3 company on the 2014 Fortune 500, is using big data to improve their auditing process, according to WSJ. Big data has helped them reduce the costs of auditing their accounts receivable by 15 percent. International Business Machines is using data such as GDP and risk to create a big data scorecard, telling them which international markets they should expand. And GM’s finance organization reportedly used big data to pull the plug on Chevrolet in Europe.

If Fortune 500s are learning to make big data work for them, and seeing those kinds of results, shouldn’t you?

3. You have a built-in advantage.

Perhaps no other member of the C-suite, or the entire company for that matter, is more equipped to wrangle meaning out of a seemingly infinite number of data sets than the finance organization.

In an excellent whitepaper, “A big role for CFOs in big data,” McKinsey & Co. outline what they see as a big role for CFOs in leading the charge on the big data front: “No matter who takes the lead, CFOs have an essential role to play,” write authors Brad Brown, David Court and Paul Willmott. “Just as they would ensure that the returns of any investment live up to expectations, CFOs should take the full measure of data-related opportunities, especially given their cross-functional nature. From defining an overall approach to deciding what to build to mobilizing talent and resources, CFOs should engage fully in planning and implementation with an eye to creating value.”

Question: What’s your finance organization’s plan to harness big data? Do you see value in it?

photo credit: reynermedia via photopin cc